Recently Posts

-

Stream

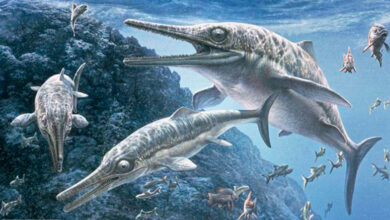

Giant marine reptile species discovered that lived during the Age of Dinosaurs

Scientists have determined that the fossils they found in the UK belong to the new…

Read More » -

-

-

-

-

-

Scientists have determined that the fossils they found in the UK belong to the new…

Read More »

Dual citizenship is obtained when two countries sign an agreement by which every citizen that obtains a second passport in the foreign…

Read More »

Tasteatlas has selected the world’s best food and drink cities. Gaziantep from Turkey ranked ninth in the list, while four…

Read More »

Education has undergone vast reformation in the past decade. Students have various choices to pursue their higher studies after secondary…

Read More »

October 2-8, 2023 weekly horoscope reviews Aries, Taurus, Cancer, Gemini, Leo, Virgo, Libra, Aquarius, Scorpio,…

Read More »

OpenAI, one of the world’s leading artificial intelligence companies, has unveiled the first music video created with Sora, a tool that can…

Read More »